Features and benefits

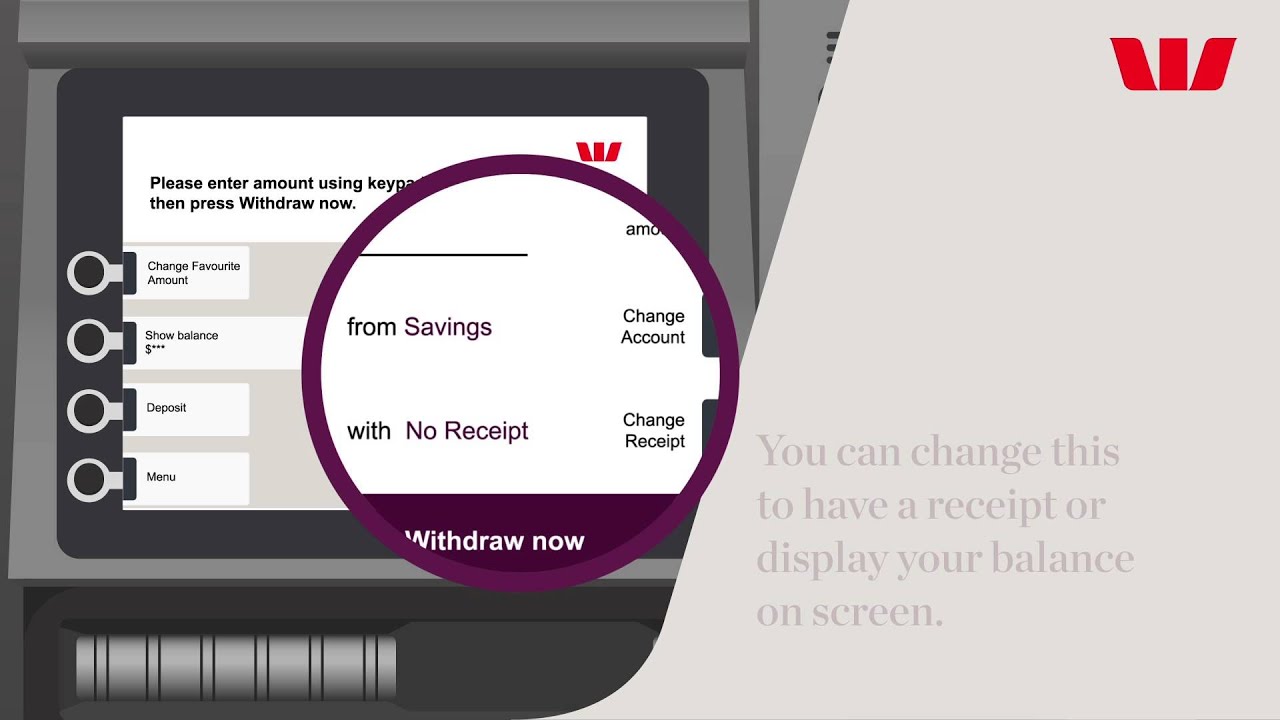

- Withdraw cash

- Check your balance

- Transfer funds between your savings, cheque and credit card accounts

- Get mini statements showing your last 10 transactions.

How to Get a Westpac Staff Super Deposit Slip. You may be asking yourself, 'How do I get a Westpac Staff Super deposit slip?' Maybe you don't live close to a Westpac Staff Super branch or ATM. Maybe you want to deposit checks too large for Westpac Staff Super's mobile app deposit limits (where you deposit checks by taking a photo). As a Westpac customer, you can withdraw cash or view account balances at all Westpac, St.George, BankSA and Bank of Melbourne ATMs free of the ATM operator fee. Plus, at most Westpac ATMs attached to a branch and selected Westpac ATMs not attached to a branch you can also.

In order to use Westpac ATMs you will need to hold a Westpac account.

Here's what to do.

To open a Westpac personal bank account, you'll need to provide us with a signed and completed personal account opening form, along with some current identification documents.

We need to verify the following:

Westpac Deposit Atm Interest Rate

- Full name

- Date of birth

- Residential address

- Occupation

- Photo identification and signature

- Citizenship

- Income source documentation

To ensure these 7 points above are verified, we need at least two primary ID documents or one primary plus two secondary ID documents. All documents must be original and current unless specified. If additional documents are required, we'll let you know.

Westpac Deposit Atm Christchurch

Download the Opening a Personal Bank Account Brochure (PDF 129KB) for a list of accepted Identification and Additional Identification required for non-residents. Visit your branch or call 132032 for more information.

Need help?

Simply speak to a Banking Representative by calling 132 032.

- Withdraw cash

- Check your balance

- Transfer funds between your savings, cheque and credit card accounts

- Get mini statements showing your last 10 transactions.

How to Get a Westpac Staff Super Deposit Slip. You may be asking yourself, 'How do I get a Westpac Staff Super deposit slip?' Maybe you don't live close to a Westpac Staff Super branch or ATM. Maybe you want to deposit checks too large for Westpac Staff Super's mobile app deposit limits (where you deposit checks by taking a photo). As a Westpac customer, you can withdraw cash or view account balances at all Westpac, St.George, BankSA and Bank of Melbourne ATMs free of the ATM operator fee. Plus, at most Westpac ATMs attached to a branch and selected Westpac ATMs not attached to a branch you can also.

In order to use Westpac ATMs you will need to hold a Westpac account.

Here's what to do.

To open a Westpac personal bank account, you'll need to provide us with a signed and completed personal account opening form, along with some current identification documents.

We need to verify the following:

Westpac Deposit Atm Interest Rate

- Full name

- Date of birth

- Residential address

- Occupation

- Photo identification and signature

- Citizenship

- Income source documentation

To ensure these 7 points above are verified, we need at least two primary ID documents or one primary plus two secondary ID documents. All documents must be original and current unless specified. If additional documents are required, we'll let you know.

Westpac Deposit Atm Christchurch

Download the Opening a Personal Bank Account Brochure (PDF 129KB) for a list of accepted Identification and Additional Identification required for non-residents. Visit your branch or call 132032 for more information.

Need help?

Simply speak to a Banking Representative by calling 132 032.